INDIAN CEP MARKET - AMONG THE FASTEST GROWING IN THE WORLD

Read also …

THE INDIAN CEP MARKET EVOLUTION

Published on 29/04/2025

Despite challenging global conditions, India remains the world’s fastest growing major economy. This has resulted in strong double-digit growth in the CEP Market and notable increases for many carriers in 2023 both in revenue and volume. The market is estimated to have reached a revenue of €11.7bn (INR 1,056bn) in 2023, growing by 11.3% vs. 2022, and a volume of 6.4 bn parcels, growing by 13.3%.

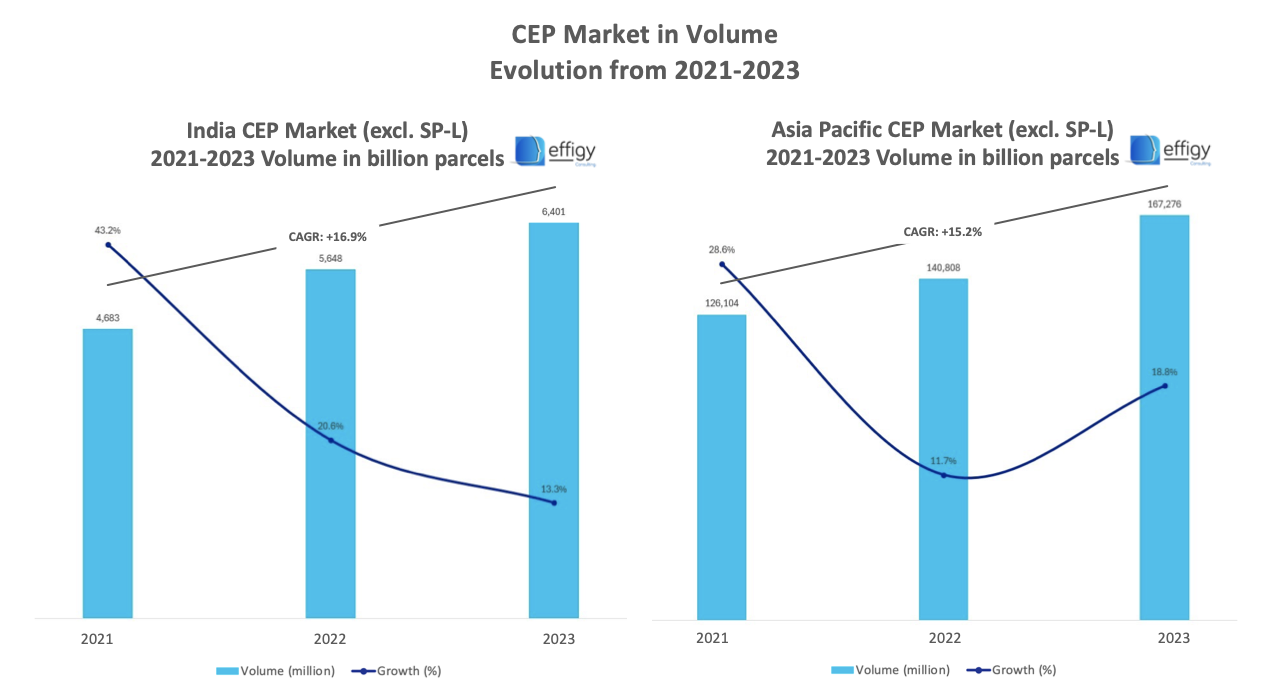

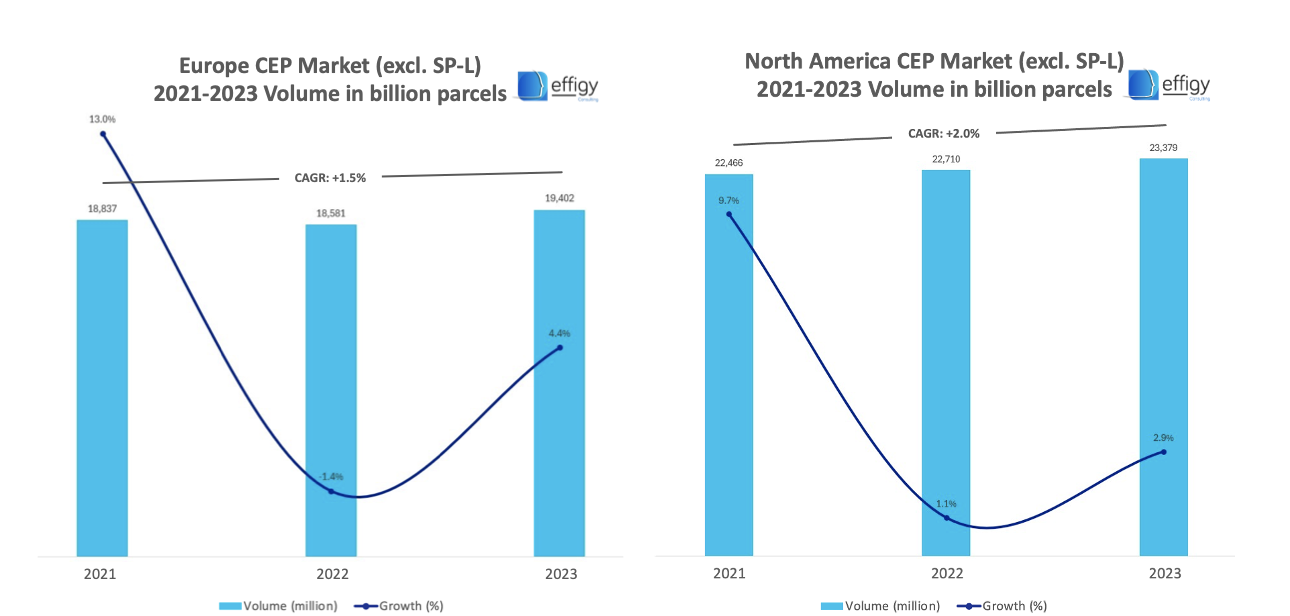

The recently released results for the Parcel Market demonstrate a strong growth over 2021-2023 for India with +16.9% in Volume, in stark contrast to Europe and North America whose markets grew by only +1.5% and +2.0% respectively. Asia Pacific’s growth (+15.2%) is strongly driven by China/Honk Kong and India.

Main Markets drivers:

The B2C/C2X segment is the main driver of the Indian market with an estimated growth in 2023 of almost 14% in volume. The rise of e-commerce has driven the demand for delivery services, but is also driving innovations in last-mile delivery and warehousing. Changes include the adoption of IoT, AI, and blockchain, which improve supply chain visibility and real-time tracking. There is also an increased emphasis on green logistics practices, such as electric vehicles and eco-friendly packaging, promoting sustainability. Challenges however remain in the market for delivery companies, for example issues with road quality, congestion, and remote area infrastructure.

The Domestic market is predominant, capturing more than 95% of parcel volumes. Intracontinental volumes are slightly larger than those of intercontinental parcels.

Mergers & Acquisitions in the Indian Market:

The India CEP market is highly fragmented due to the size of the Domestic market, the large population and the geography of the country. The Effigy Consulting CEP Market database includes no more than 16 carriers, i.e. Amazon, Aramex, Blue Dart, Delhivery, DHL Express, DTDC, Ecom Express, eKart, FedEx, Gati, India Post, Safe Express, Shadowfax, UPS, VRL, XpressBees and others.

Several recent announcements highlighted the following Mergers & Acquisitions:

- Delhivery recently announced recently that it was acquiring Ecom Express. Note that FedEx has a minority stake in Delhivery.

- Gati was acquired by Allcargo Logistics in 2020. In June 2023, Allcargo Logistics and Gati completed the acquisition of the remaining 30% stake in Gati-Kintetsu Express (Gati-KWE). The name of the company has since been changed to ‘AllcargoGATI’.

- Shadowfax fully acquired CriticaLog, early 2025, a premium logistics firm specializing in high-value item transportation.

Major carriers in India:

The top five players of the Indian CEP market in volume in 2023 were eKart, XpressBees, India Post, Delhivery and Ecom Express, holding 67.5% of the market in volume. The main carrier by far is eKart holding more than 20% of the Indian CEP Market in volume. They are considered to be one of India’s largest supply chain providers of end-to-end solutions.

The main carriers were ranked as follows:

|

In Revenue for 2023

Rest of the market

|

In Volume for 2023

Rest of the market

|

The preliminary overall results for 2024 suggest a growth of +9.4% in revenue and +14.7% in volume. The longer-term forecast for the India CEP market is that it will keep growing at a strong pace.

For further details on our dedicated Indian CEP Market Report, please refer to our Country CEP Market Reports Section.