EUROPEAN CEP MARKET TRENDS 2021-2030

Read also …

THE EUROPEAN CEP MARKET TRENDS FROM 2021 TO 2030

Published on 03/04/2025

Effigy Consulting is thrilled to announce that Philippe Masquelier, its managing director, was interviewed by CEP Research.

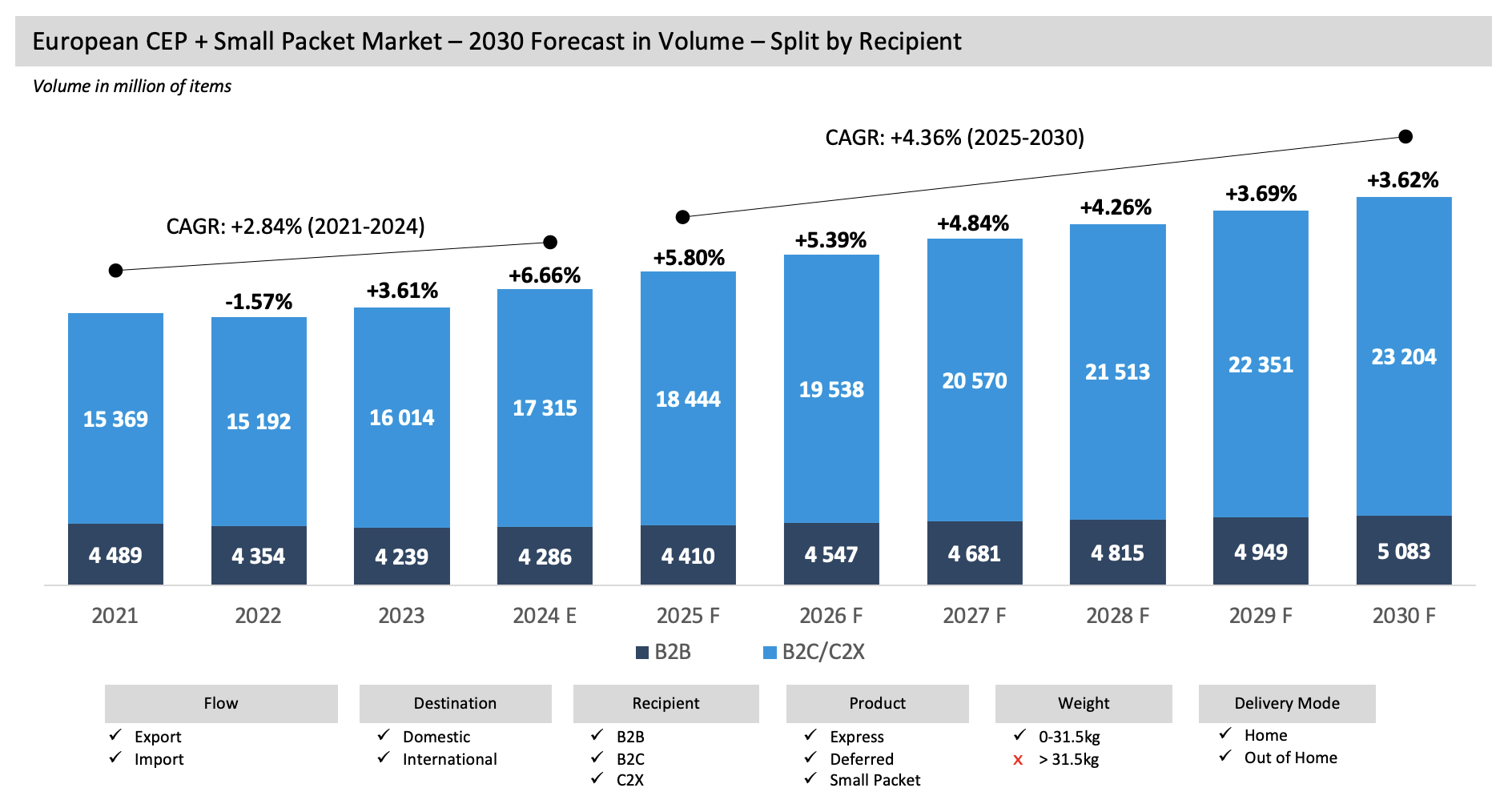

This Preview is based on a consolidated analysis of 2023 figures which allowed us to create an estimate market for 2024. Note that 2025 to 2030 data are considered forecasts. This analysis is an extract of the full European CEP Market Report.

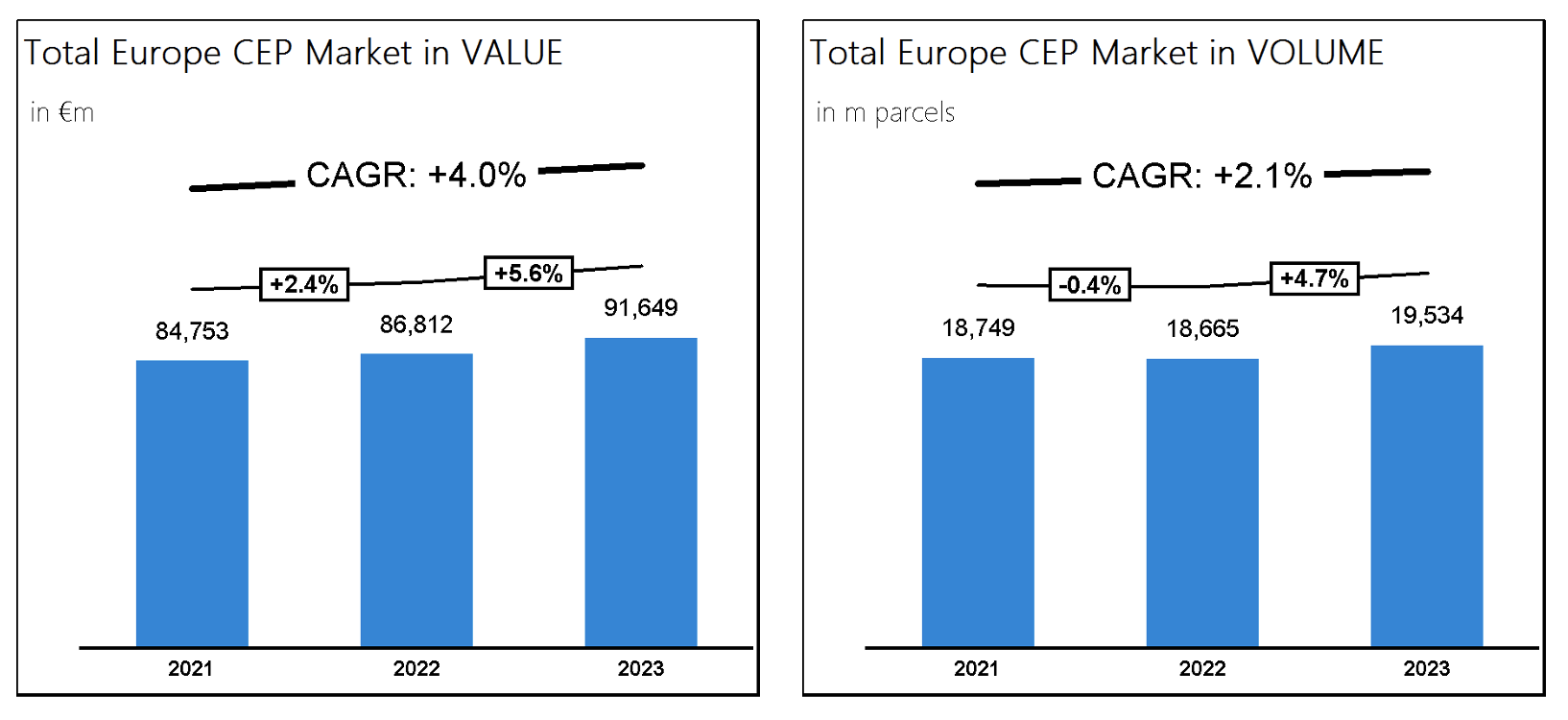

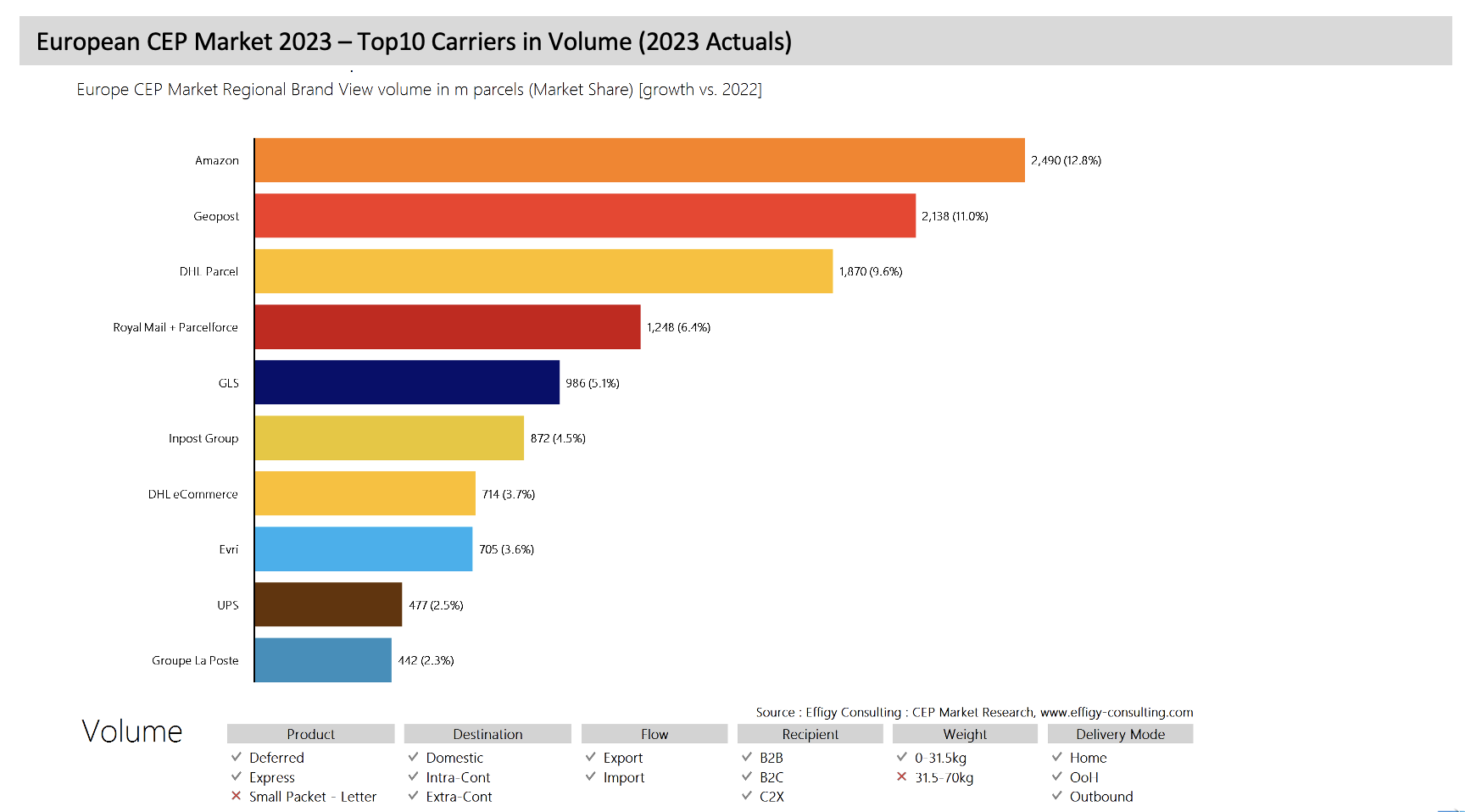

The European Courier, Express and Parcel (CEP) Market managed to grow by +4.7% in volume in 2023 after a challenging year in 2022 while revenue increased by +5.6% across Europe (32 countries), which is twice as much as 2022 (+2.4%). Meanwhile, Amazon is now the continent’s biggest parcel carrier ahead of Geopost and DHL. In terms of growth rates, we are, of course, far from the Covid years but economic and geopolitical conditions are much more challenging nowadays. The total volume for Europe for 2023 is estimated at 19.5bn parcels. If you include the small packet-letters managed through the postal networks, the total volume rises to 20.3bn parcels.

CEP-Research: What are the trends of the CEP Market before, during and after Covid?

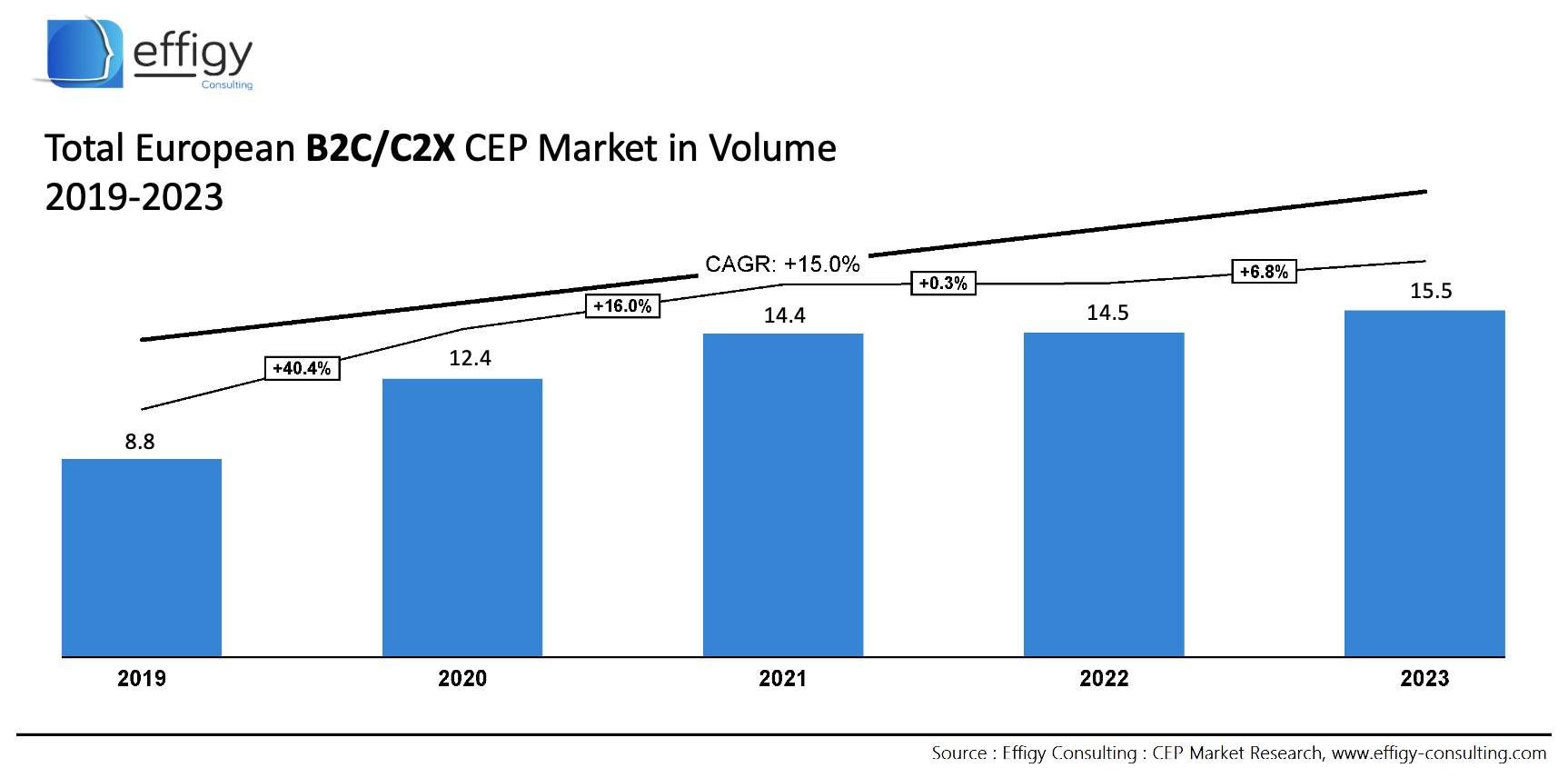

Philippe Masquelier: The Covid pandemic boosted the CEP market dramatically since people had to stay at home and e-commerce surged as a result. New e-consumers such as elderly people kept ordering online after the pandemic, so the CEP market remained high even though we saw a stagnation in 2022, but this is also due to economic and geopolitical situations. We see the B2C/C2X CEP Market pick up again, with some growth driven by Amazon and by the new generation of Chinese eTailers.

CEP-Research: What are your main findings concerning the European CEP market in 2023? What were the main trends concerning B2C and B2B parcels as well as international and domestic parcels? Were there any surprises?

Philippe Masquelier: The 2023 volume growth (+4.7%) was mainly driven by the B2C and C2C segments whilst B2B volumes have decreased. B2C/C2C volumes have benefited from a boost from Amazon and from Chinese eTailers such as Alibaba, Temu, Shein and the upcoming TikTok shop. Note that such volumes are considered as Domestic and/or Cross Border based on their operational setup. The growth in revenue is slightly higher (+5.6%) than volume, thanks to sustained prices in the B2B segment resulting in a slight positive growth versus 2022.

The Domestic segment have grown slightly faster in volume with +5.0% than the International segments (+1.5%), but this is slightly biased since the starting point of the Chinese Imports are considered within European warehouses.

CEP-Research: How is the European CEP Market in 2023 versus China and USA in term of volume? Are those markets moving at different paces?

Philippe Masquelier: This 19.5bn parcels of the European CEP Market is by far much lower than the Chinese CEP Market, which is estimated at over 150bn parcels (excluding small packet-letters) where Domestic represents more than 95% of the total volume. The Chinese CEP market has grown in 2023 at a double-digit rate.

The US CEP Market is close to the European one with around 20bn parcels (excluding small packet-letters) in 2023 with a slight increase versus 2022.

Philippe Masquelier: After a challenging 2022 due to the war in Ukraine, energy supply interruptions and the rising inflation, the CEP Market has regained ground in 2023 thanks to the B2C/C2X segments driven by marketplaces such as Amazon, Temu, Shein and Alibaba. It is expected that TikTok Shop will also become a strong driver for growth in 2024/2025.

The traditional B2B segment is stagnating but the B2B e-commerce market is expected to manage exponential growth driven by accelerated digitalization of businesses, the emergence of new technologies (artificial intelligence, big data, etc.), and changing buyer behaviours.

Important note: due to a lack of data and the difficulty of making a reliable projection due to the war, Russia and Ukraine have been excluded from this year’s forecast. The perimeter below is on 30 countries (versus 32 countries on the 1st chart) including Small Packets but excluding Intra-Continent Imports and Heavy Weight.

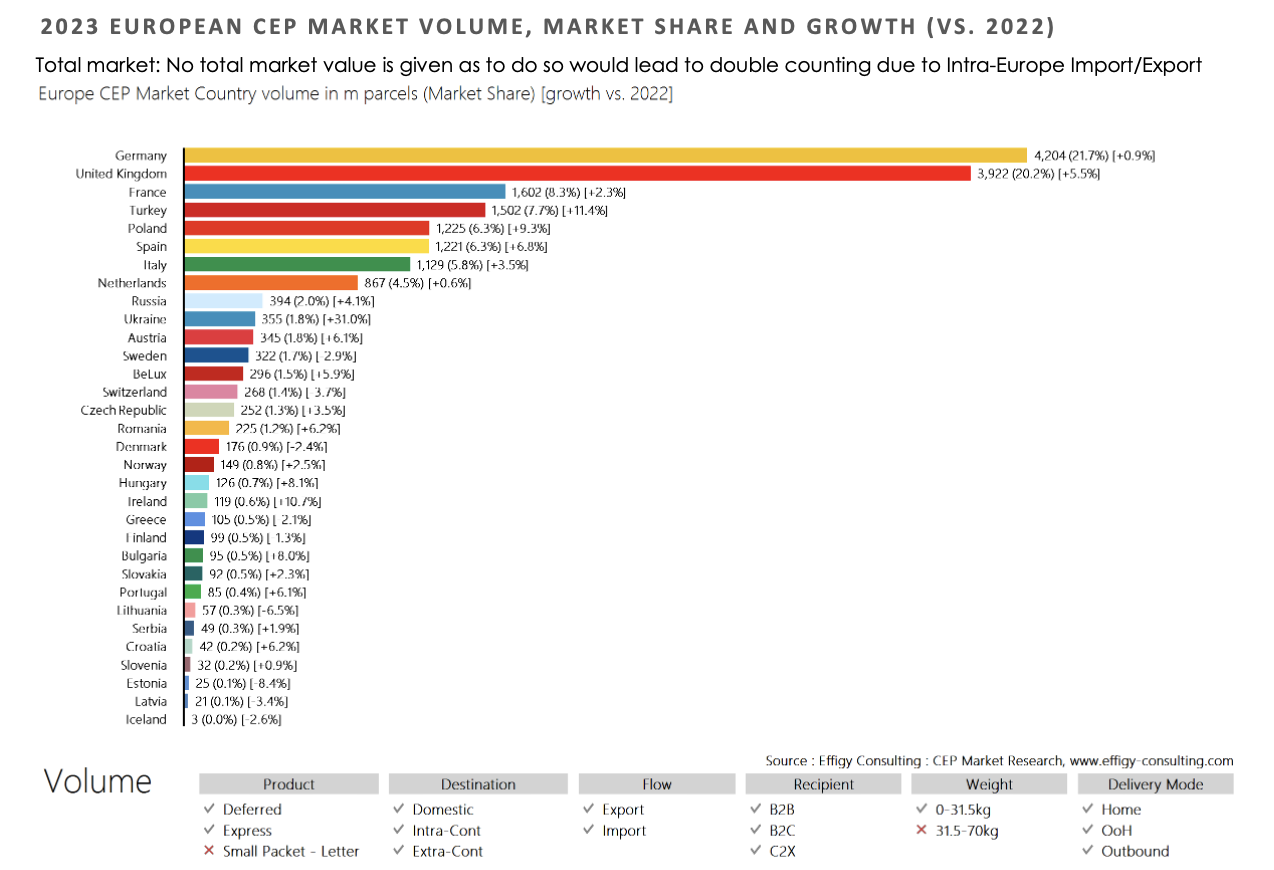

CEP-Research: What about individual markets in Europe? Which ones grew fastest in 2023 in volume?

Philippe Masquelier: In general, only a few markets enjoyed double digit growth in volume e.g. Turkey +11.8% and Poland +10.4%. Note that Ukraine had a strong growth, but this market should be considered separately due to the local political situation.

The largest markets (Germany, United Kingdom, Poland, France, Spain, Italy and the Netherlands) have all managed to have positive growth. Several countries faced a drop on their CEP parcel volumes e.g. Switzerland, Sweden, Denmark, Lithuania, Estonia and Iceland.

CEP-Research: In terms of carriers, which companies appear to be most successful in Europe – and why?

Philippe Masquelier: Amazon is the leader of the European CEP market in terms of volume, with a market share of the total European market (in volume) of 13.4% thanks to its own delivery network in 10 countries in Europe. Geopost (former DPD group) follows in terms of volume with 10.9% of the market share and maintained its lead of the European CEP market in revenue in 2023. DHL Parcel (Germany) follows Geopost both in terms of revenue and in terms of volume with a market share of 9.6%. Royal Mail + Parcelforce recovered from the drop in its activities seen in previous years, and managed to grow volume in 2023. GLS is ranked fifth across Europe with a share of 5.1%. The InPost Group continues to grow at a high rate and to drive Out-of-Home deliveries (especially to lockers).

The evolution of new generation carriers was once again strong in 2023. These carriers focus on meeting consumers’ delivery expectations (parcel shops, lockers, evening deliveries, same day, etc.) at competitive prices. Among them we can name Packeta, Paack, Homerr, FOXPOST, Quickpac, Orlen Paczka, etc.

The following graph shows the Top 10 parcel carriers in Europe in volume and market share in 2021.

For more in depth information, please refer to our European CEP Market Report Section.